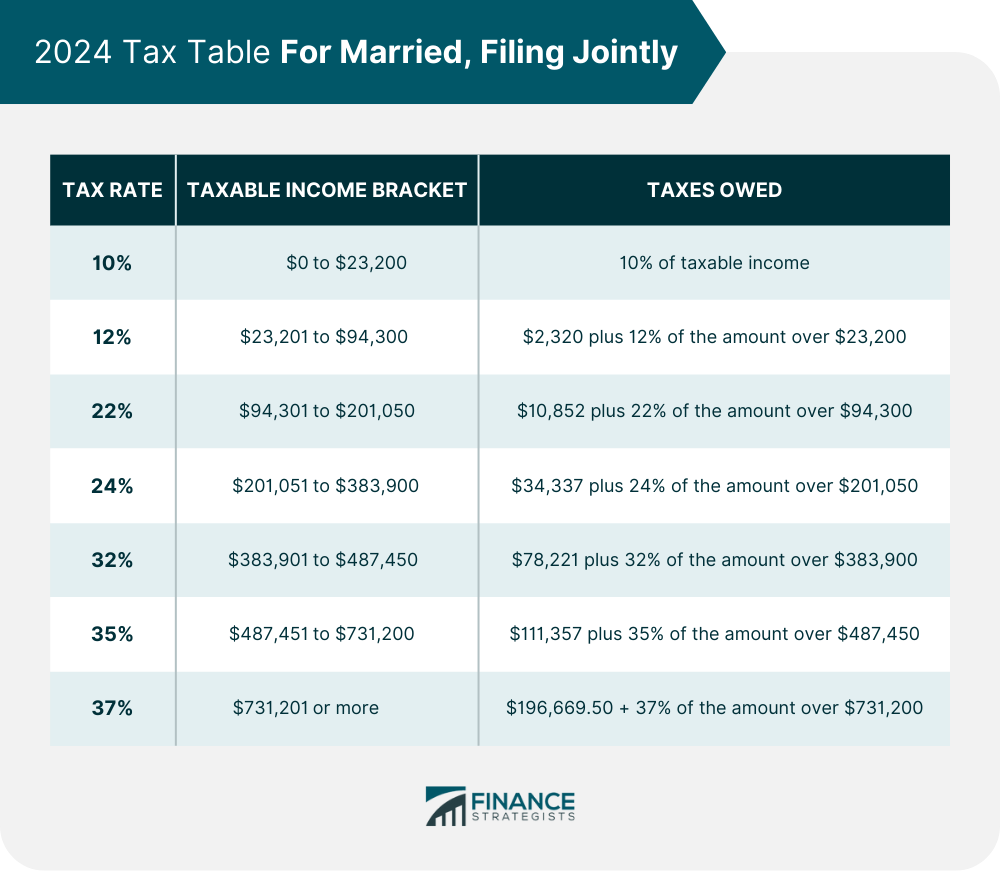

2025 Married Filing Jointly Tax Table. Single filers age 65 or older who are not surviving spouses may increase their standard deduction by $1,950 and married filing jointly filers may increase their. For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22%.

Single filers age 65 or older who are not surviving spouses may increase their standard deduction by $1,950 and married filing jointly filers may increase their. Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

Tax Brackets 2025 For Married Filing Jointly Mag Imojean, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%.

2025 Tax Tables Married Filing Jointly Tammy Philippine, A the percent of scheduled benefits payable is projected to decline to 69 percent by 2098.

2025 Tax Brackets Announced What’s Different?, In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

Married Filed Jointly Tax Brackets 2025 Polly Camellia, Each bracket applies to a different taxable income.

2025 Irs Tax Tables Married Filing Jointly Ashlee Donella, For instance, owning an account or a parcel of real estate jointly, with one or more other owners, as joint tenants with rights of survivorship (also called simply, “joint.

Tax Brackets Definition, Types, How They Work, 2025 Rates, See current federal tax brackets and rates based on your income and filing status.

2025 Tax Rate Tables Married Filing Jointly Delly Fayette, See current federal tax brackets and rates based on your income and filing status.

2025 Married Tax Brackets Married Jointly And Margy Analiese, Here you will find federal income tax rates and brackets for tax years 2025, 2025 and 2025.

2025 Tax Tables Married Filing Jointly Tammy Philippine, For example, if you’re married filing jointly for 2025 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your.

2025 Tax Tables Married Filing Jointly Single Member Hanny Goldarina, The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: